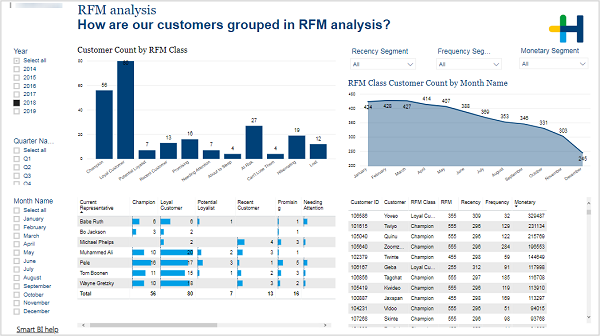

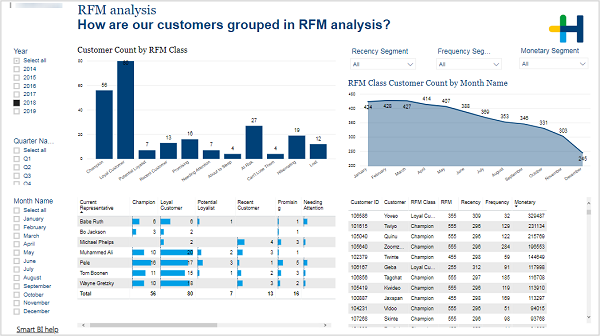

RFM analysis - How are our customers grouped in RFM analysis?

(Change language of this page to: English, Deutsch)

This page can assist you in making decisions based on different customer categories. The customers are categorized by recency, frequency and monetary aspects.

RFM analysis uses three different variables to determine the category a customer belongs to.

•Recency (R): How many days ago did the customer place their last order?

•Frequency (F): How many orders did the customer make in the last 12 months?

•Monetary (M): What is the value of the orders of the last 12 months?

Each customer gets a value from 1 to 5 for each of these variables, with 1 being not good, 5 being good.

|

RFM Class |

R |

F |

M |

Description |

|---|---|---|---|---|

|

Champion |

45 |

45 |

45 |

Bought recently, buys often and spends most! |

|

Loyal Customer |

2345 |

345 |

12345 |

Spends often good money. |

|

Potential Loyalist |

345 |

12345 |

345 |

Recent customer, spends a good amount. |

|

Recent Customer |

345 |

12 |

12 |

Has done a purchase most recently, but not often. |

|

Promising |

23 |

12 |

12 |

Has done a purchase recently, but didn't spend much. |

|

Needing attention |

23 |

12 |

23 |

Above average recency, frequency and monetary value, but not superb. |

|

About to Sleep |

12 |

2345 |

2345 |

Below average recency, frequency and monetary value. |

|

At Risk (1) |

12 |

1 |

345 |

Spends big money, but did not purchase anything for a long time. |

|

At Risk (2) |

1 |

345 |

1 |

Bought a lot, but has not been seen for a long time. |

|

Can’t Lose Them |

12 |

12 |

12 |

Keeps ordering small amounts only some times per year. |

|

Hibernating |

1 |

1 |

1 |

Last order was long time ago, for a small value and only some orders. |

|

Lost (no data) |

0 |

0 |

0 |

No data available for the last 12 months. |